Fixed Income Quarterly - Q1 2024

Macro-Economic Overview

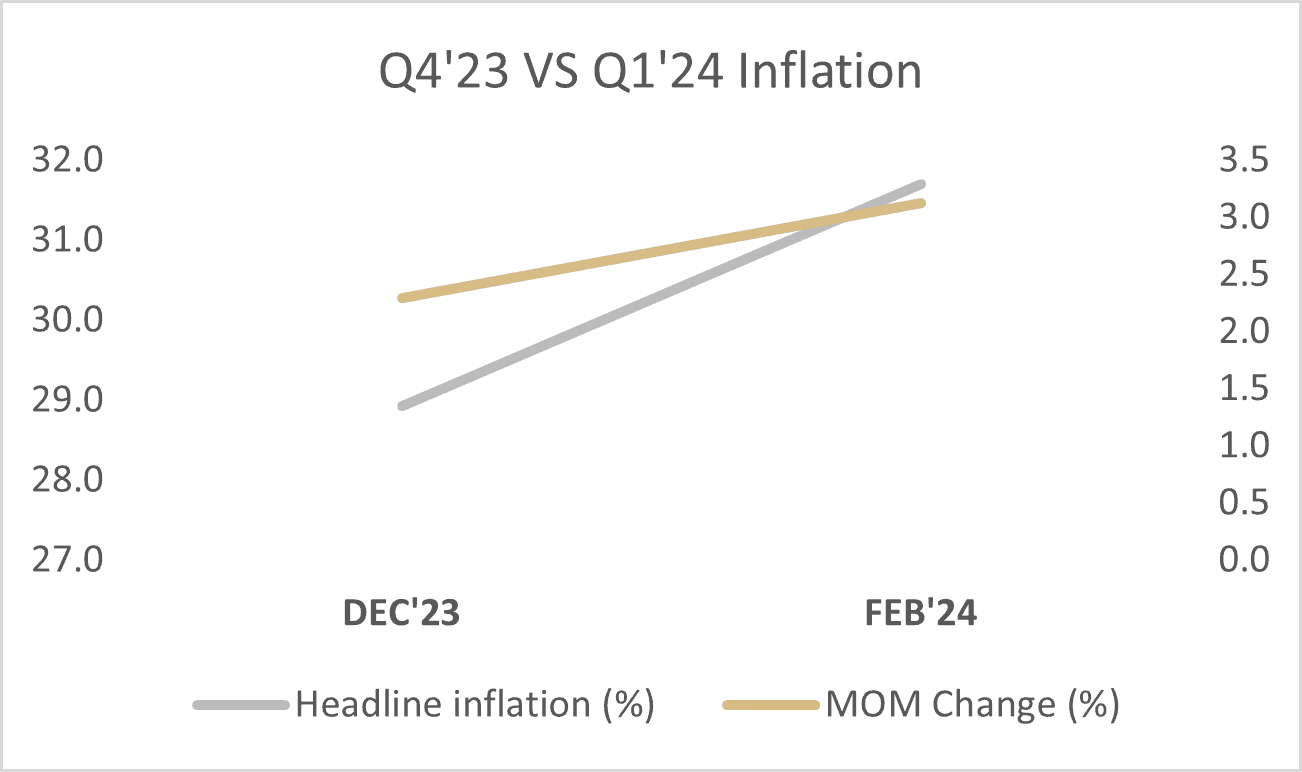

- Nigeria’s inflation hit an all-time high, reaching 31.70% in February, with food inflation at 37.92% and core inflation at 25.13%.

- To contain the fast-rising consumer prices, the MPC continued its hawkish stance, as the MPR was increased by 400bps to 22.75% in February, following a further jump to 24.75% in March. The asymmetric corridor changed to +100/-700 in February before it was returned to the previous range (+100/-300 around the MPR) in March. The CRR was also increased to 45% from 32.50%, while the liquidity ratio was retained at 30%.

- Oil prices averaged $81.66/b in Q1, peaking at $87.70/b on the 19th of Mar, on the back of the disruption to the Russian refining activities following attacks from Ukraine.

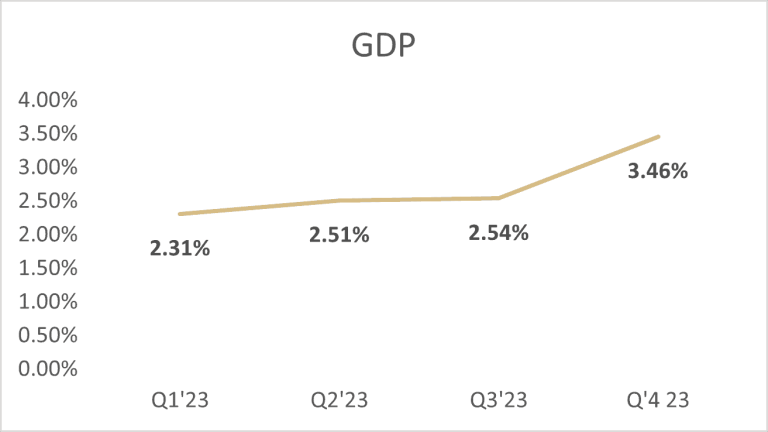

- Nigeria’s Gross Domestic Product (GDP) grew by 3.46% y-o-y (year-on-year) in real terms in the fourth quarter of 2023, coming from a 3.52%y-o-y recorded in Q4’2022. The growth recorded was largely driven by the service sector, which recorded a growth of 3.98% y-o-y.

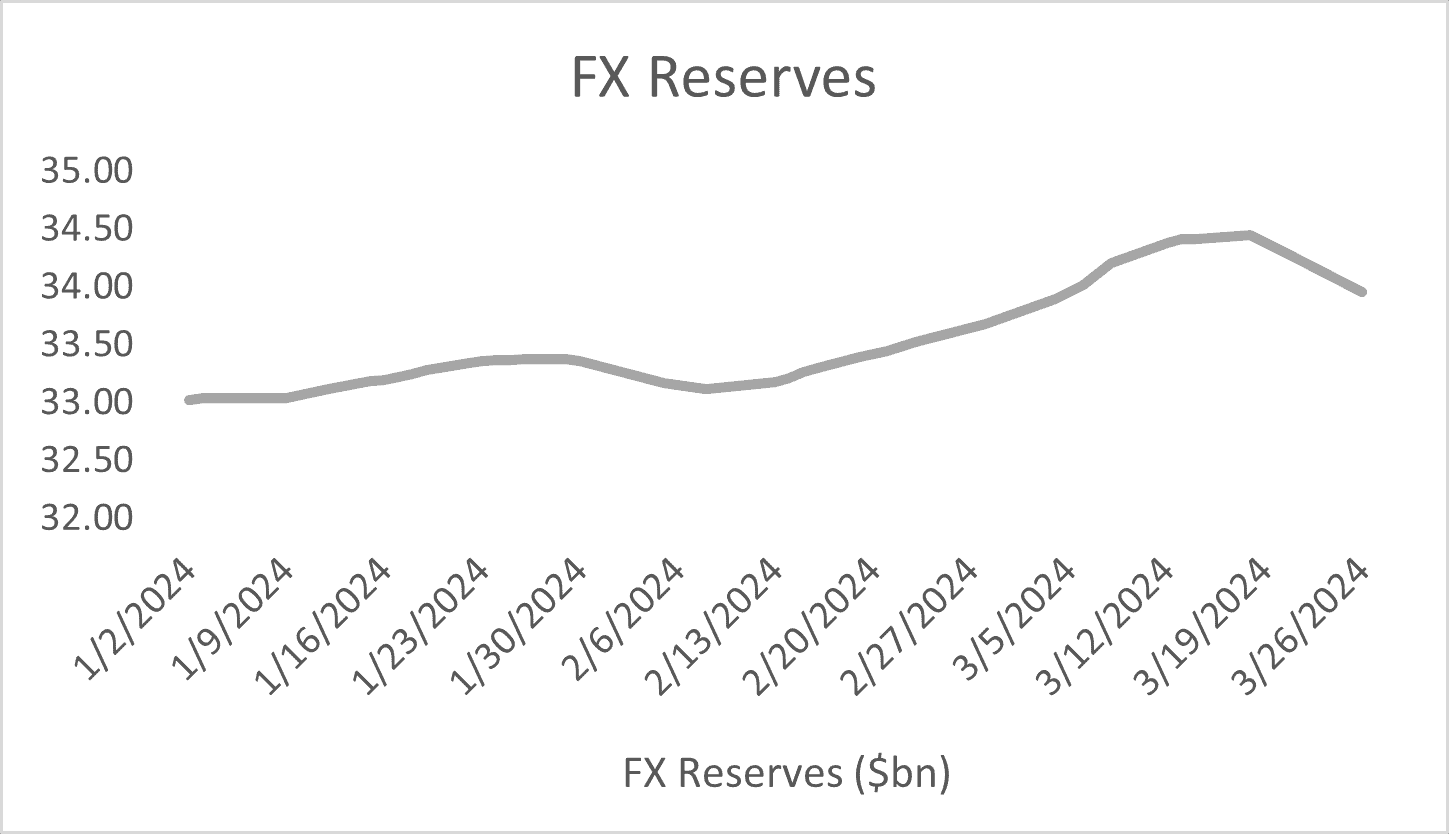

- The Nigerian FX reserve has recorded some improvement this quarter, as it currently stands at $34.3bn coming from $32.9bn in Q4 2023. This can be attributed to improved diaspora remittances, foreign portfolio investment and crude oil earnings amidst settlement of outstanding forward contracts.

- Interbank liquidity averaged repo c.N236bn through the quarter, with a high of c.N863bn early January and a low of repo c.N2.29trn mid-March.

- The Total FAAC disbursement for the quarter stood at c.N3.40trn with February recording the highest at c.N1.15trn.

Market Performance in Q1-2024

Bond market

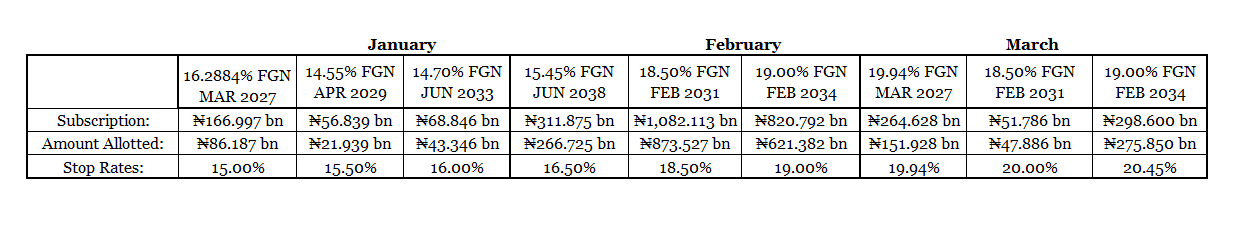

The bond market opened the year with participants trading cautiously while awaiting the Q1 bond auction calendar. The Jan-24 bond auction release saw the removal of 53s which led to a bit of rally especially on the 2053 paper. The first auction of the year saw stop rates close higher leading to yields adjusting across the curve in the secondary market amid sparce bids as players focused on the shorter end of the curve. The bearish bias continued mid quarter with offers across the curve as bids remained limited. The Feb-24 bond circular saw new 7-year and 10-year bond issuance which further fueled the bearish bias. Following the outcome of the auction with papers closing significantly higher, the bond curve adjusted yet again in the secondary market.

Towards the end of Q1, activity waned in the bond market as most players remained on the sidelines. The bond circular for Mar saw the re-opening of the 7-year and 10-year papers and the introduction of a new 3-year issuance. Following the auction, bearish sentiments amid cautious approach was sustained as there was also a private sale of N2.35tn worth of bonds (new 26s, new 27s, new 28s) by DMO. Closing the quarter, average yield rose by c.126bps across the curve.

Treasury bill market

The Treasury bills market opened the year with bullish bias on the back of the system liquidity. The continued demand drove yields lower leading to a resistance in the market towards the end of the month. This led to a reversal in yields coupled with the lower system liquidity witnessed amid the high stop rate in the persistent OMO auctions by the CBN. Mid quarter, bearish sentiments were dominant as market players sold off their positions in a bid to prepare for the high yield environment. This bearish momentum was further fueled by the NTB auction calendar with an over c.N1tn offer and anticipated increase in MPR. Most activity remained on the newly issues papers.

Towards the end of the quarter, the treasury bills market recorded mixed sentiments albeit with a bearish bias on the back of the low system liquidity. A bit of cherry picking was seen especially on the long end. Offers were seen across board especially on the longer end of the curve as players sold off their positions to meet their obligations. The quarter ended with the Feb-25 and Mar-25 maturities trading around 18.85% and 18.95% respectively.

Eurobond Market

The SSA Eurobond market started the year with cautious optimism. The market in Q1 2024 has been influenced by a variety of factors, including global economic trends, geopolitical developments, central bank policies, and domestic economic conditions. Some nations reported improved economic growth and improved fiscal positions, supporting investor confidence in their sovereign bonds, while others grappled with challenges such as high inflation, fiscal deficits, and debt sustainability concerns.

SSA sovereigns faced pressures at the start of 2024 due to fiscal concerns and a stronger dollar from a high interest rate driven by global central bank inflation-fighting policies via rate hikes. African countries are, however, now returning to the international debt capital market to access funds amidst sluggish economic expectations in 2024, as expectations of a possible global rate cut in 2024 continue to support investors’ interest.

Global Economic Factors

Economic data from the United States, including 3.4% GDP growth in Q4 2024 (vs. 4.9% in Q3 2023) and mixed signals in the labour market (highest unemployment rate since January 2022 at 3.90% vs. 275,000 added jobs in February, up from 229,000 in January), drove moderate uncertainty in the pace of anticipated rate cuts later in the year. Also, escalating geopolitical tensions, including the Russia-Ukraine and Israel-Palestine wars and their impact on energy prices (brent crude briefly crossed $87 per barrel), contributed to market volatility. Concerns over inflationary pressures and supply chain disruptions from attacks by rebels in the Red Sea also influenced market sentiment.

The central banks of developed economies, including the US Federal Reserve, maintained a cautious approach to monetary policy. The Fed signalled a holding pattern on interest rates, recently leaving rates unchanged in March. However, the Fed’s stance leans towards three cuts by the end of 2024, contingent on inflation continuing to decline towards their target of 2%. Investors in the SSA Eurobond market generally interpreted the US Fed stance with cautious optimism.

Country Event

Nigeria

Nigeria’s Eurobond market saw mixed performance in Q1 2024. During the quarter, factors like the apex bank’s order to local banks to close their net open positions drove moments of bearish sentiment. Yields were, however, relatively stable, supported by favourable domestic economic reforms and efforts to address forex challenges. The Central Bank of Nigeria (CBN) aimed to improve stability by clearing backlogs of matured non-deliverable forwards (NDF). However, concerns over inflationary pressures and fiscal sustainability remained key considerations for investors.

Ghana

Ghana’s Eurobond market witnessed fluctuating yields in Q1 2024 amid ongoing discussions with the IMF. Ghana’s successful completion of reviews under the IMF Extended Credit Facility program signaled progress on fiscal consolidation and economic management. The IMF program will help Ghana shore up its foreign reserves and make the economy less vulnerable to external shocks. The government during the quarter emphasizes tax administration improvements, spending control, and better management of state-owned enterprises.

After a long journey from it’s 22-year high of 54.1% in January 2023, Ghana’s inflation dropped by 30 basis points to 23.2% year-on-year in February, after increasing by 30 basis points in January 2024. The government has demonstrated commitment to controlling inflation through tighter monetary policy from the Bank of Ghana.

Kenya

Kenya’s sovereigns maintained stability in Q1 2024, bolstered by continued implementation of fiscal consolidation plans under a program with the IMF. The Central Bank of Kenya (CBK) further raised the policy rate, in line with the IMF program, by 50 basis points in February to a decade-high of 13.00%, after a 200-basis point in December 2023. Amid high-interest payments on its existing debt, Kenya announced a buyback program for a USD 2 billion, 10-year Eurobond issued in 2014. This program aimed to manage debt by repurchasing existing bonds, potentially reducing overall debt, and improving debt sustainability metrics. The buyback was financed by issuing a new Eurobond.

Zambia

Driven by a large interest rate hike and the apex bank’s order that local banks hold back more funds in reserve, Zambia’s currency, the Kwacha, strengthened to become the world’s performing currency. The Bank of Zambia raised the reserve ratio to 26% from 17% and followed that up in February by increasing the policy rate from 11% to 12.5%, the highest level in almost seven years.

Under the G-20’s Common Framework, Zambia reached an agreement to restructure $3 billion in Eurobonds towards the end of the quarter. Bondholders would forgo a haircut of 21.6% of the total nominal face value of the bonds, including past-due interest. Investors will be invited to exchange their old Eurobonds into two new government bonds: Bond A for $1.7 billion and Bond B for $1.35 billion. Following this development in late March 2024, the sovereigns extended their price rally to the highest since May 2022, with the price on the 2027 paper rising above USD 72.00. Among the loans Zambia still needs to revamp are $1.9 billion borrowed from state-owned creditors in China.

Q2 2024 Outlook

Bond Market

We anticipate the continued high yield play in the FGN local bond space amid cherry picking across the curve as players continue to scout for attractive levels.

Eurobond market

As the risk premiums on SSA papers decline, the outlook for the SSA Eurobond market in Q2 2023 remains cautiously optimistic. Investors still look forward to rate cuts by the US Fed, considering that projections are now shifting to two rate cuts vs three earlier projected.

In Nigeria, we look forward to the developments on the planned Eurobond issuance, although the news was debunked by the DMO.

For Ghana, we are on the lookout for the actual impact of their reforms, which depends on sustained progress with the IMF program and continued economic stability. Political events, like the upcoming December 2024 general election, could also introduce some uncertainty for investors.

For Kenya, the success of its IMF program and sustained economic recovery will be crucial for long-term investor confidence. Also, Kenya’s ability to manage its debt burden and diversify its revenue streams will be key factors influencing the Eurobond market.

For Zambia’s outlook, rising global copper prices, Zambia’s major export, could boost government revenue and economic growth. Overall, Zambia’s success in controlling inflation, maintaining a stable exchange rate, and implementing growth-oriented policies will be crucial for investors’ appetite for their sovereigns.