Fixed Income Quarterly - Q3 2023

Macro-Economic Overview

- Nigeria’s inflation continued to climb, reaching 25.80% in August, over 300bps increase from figures as at the end of Q2 2023.

- On the back of the persistent rise in inflation, the MPC decided to increase the MPR by 25bps to 18.50%, narrow the asymmetric corridor to +100/-300 basis points around the MPR, while retaining the CRR and Liquidity ratio at 32.50% and 30% respectively at the July 2023 MPC meeting. The September meeting was postponed to further notice

- A new CBN governor, Dr. Olayemi formally assumed duty in an acting capacity last week Friday, September 22, 2023, after which the Senate approved his nomination. New Deputy Governors of the Central Bank of Nigeria were also confirmed by the Senate.

- Oil prices averaged $83.80/$ in Q3, peaking at $96.55/$ on 27Sep on the back of the tight global supplies, following the deal to reduce production by major producers – Saudi Arabia and Russia. Brent crude oil closed the quarter at $96.10/b.

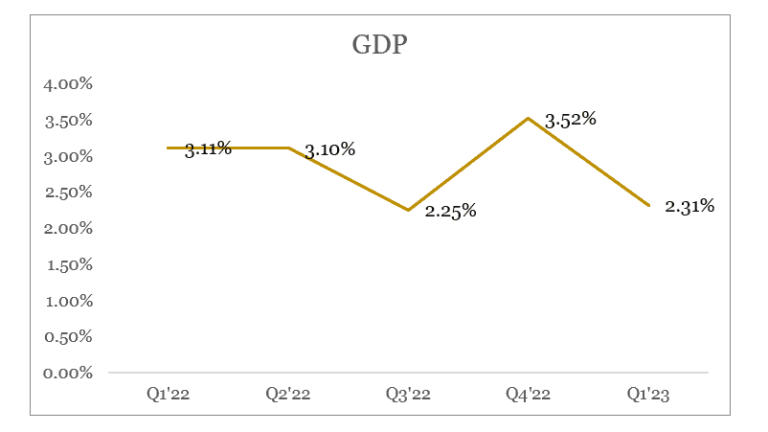

- Nigeria’s Gross Domestic Product (GDP) grew by 2.51% (year-on-year) in real terms in the second quarter of 2023. This growth rate, lower than the 3.54% recorded in Q2’2022, can be attributed to the challenging economic conditions in the nation.

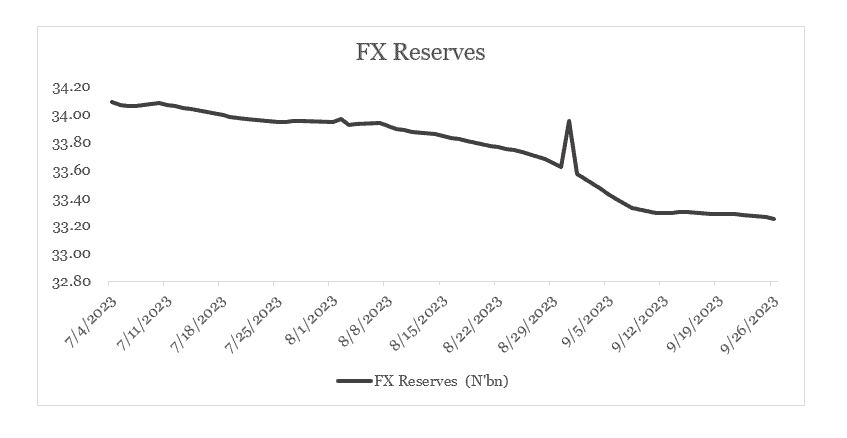

- The Nigerian FX reserve dropped to $33.25bn as at 26th September, amid FX supply challenges.

- Interbank liquidity averaged c.N312bn through the quarter, closing around c.N35bn after hitting a high of c.N896bn early July and a low of repo c.N396bn mid September.

- Total FAAC disbursement for the quarter was c.N2.042trn with c.N1.15trn for Jul and c.N891.93bn for May respectively.

Market Performance in Q3-2023

Bond market

The Nigerian local bond market traded on a mixed note during Q3 2023, with yields generally trending upwards. The bears dominated the market in July and August, following the MPC’s decision to increase the monetary policy rate by 25bps to 18.75%. However, the market turned mildly bullish in towards the end of September, with demand skewed to the shorter-term maturities. Yields on benchmark bonds rose by 150 bps on average during the quarter.

The market climate, however, took a turn as September drew to a close, with a mild bullish wave encompassing the market. Notably, there was an increase in demand for shorter-term maturities. The fluctuating trends culminated in a net increase of the benchmark bond yields by an average of 150 basis points by the end of the quarter.

Several factors came into play to drive these trends in Q3 2023:

- Hawkish CBN stance: The Central Bank of Nigeria (CBN)’s hawkish stance to curb inflation was a key driver of the upward trend in bond yields in Q3 2023. The CBN raised the monetary policy rate by a cumulative 100 bps over the quarter, to 18.75%. This increase in interest rates made it more expensive for borrowers to borrow money, which in turn led to a rise in bond yields.

- Inflation concerns: Inflation remains a major concern in Nigeria, with the headline inflation rate rising to a 17-year high of 20.52% in August 2023. High inflation erodes the purchasing power of investors, making them less willing to invest in long-term bonds with fixed interest rates.

- System liquidity: System liquidity tightened in Q3 2023, due to a number of factors including the CBN’s open market operations (OMOs) and the loan-to-deposit ratio (LDR) policy. This tightening in liquidity made it more expensive for banks to lend money, which in turn led to a rise in bond yields.

Treasury bill market

The treasury bills market recorded mixed sentiments amid cautious trading in Q3.

The quarter started off with bullish bias as participants sourced for attractive on the back of the relatively liquid system. Mid quarter, offers improved across board following the significant hike in the stop rates at the auctions, and tight system liquidity, as players looked to fund their obligations.

Also, the CBN floated the first OMO auction of the year which saw participants looking to exit their positions in anticipation for higher yields.

Throughout the quarter, we recorded an uptrend in stop rates at the auction, save for the last auction which saw a decline of 151bps, 45bps and 161bps on the standard tenors respectively. All in all, stop rates improved by 213bps, 305bpsand 543bps to close the quarter at 4.99%, 3.05% and 11.37% respectively.

Eurobond Market

The SSA Eurobond market experienced a volatile Q3 2023, with yields fluctuating on global economic factors, domestic economic developments, and central bank decisions. The quarter began with bearish sentiment, as the US Federal Reserve signaled more rate hikes due to persistent core inflation. However, sentiment turned bullish in mid-July following favorable US CPI data (down from 4.10% to 3.00%) and strong consumer sentiment. This bullish trend continued through late July, as the US economy beat expectations and inflation remained controlled.

However, the market turned bearish in early August, following a US credit rating downgrade, to AA+ from AAA, citing fiscal deterioration and repeated down-the-wire debt ceiling negotiations that threaten the government’s ability to pay its bills. The market remained mixed for the remainder of August, as investors weighed global economic risks and domestic economic developments. In September, the market saw bearish sentiment again, as US inflation surged from 3.20% to 3.70%, and the Fed maintained a hawkish stance. Overall, the SSA Eurobond market experienced a volatile Q3 2023, with yields fluctuating on a range of factors.

There was a shift in investor focus towards shorter-maturity Eurobonds. This suggests that investors are seeking to reduce their exposure to long-term risk.

Country Event

Nigeria

Nigeria’s Eurobond market experienced mixed performance in Q3 2023. Yields were up in the early part of the quarter, but turned bullish in mid-July following favorable US CPI data and strong consumer sentiment. However, yields rose again in early August following a US credit rating downgrade. The market remained mixed for the remainder of the quarter, as investors weighed global economic risks and domestic economic developments.

In terms of domestic economic developments, Nigeria’s inflation rate hit a 10-year high in August, driven by fuel subsidy removal. This led to concerns about the impact on economic growth and financial stability. However, the Nigerian government announced plans to address a $10 billion forex backlog, which could provide some relief to the economy.

Ghana

Ghana’s Eurobond market also experienced mixed performance in Q3 2023. Yields were up in the early part of the quarter, but turned bullish in mid-July following favorable US CPI data. However, yields rose again in late July and August, as Ghana’s inflation rate soared from 42.50% to 43.10% and the country faced an economic crisis.

The Ghanaian government is currently in talks with the IMF for a bailout package, which could help to stabilize the economy and support the Eurobond market. However, the outcome of these talks is uncertain, and the Ghanaian Eurobond market is likely to remain volatile in the near term.

Kenya

Kenya’s Eurobond market experienced relatively strong performance in Q3 2023. Yields were down in the early part of the quarter, and remained relatively stable throughout the rest of the quarter. This was despite the Kenyan government reinstating fuel subsidies amid debt concerns.

The Kenyan economy is relatively resilient, and the government is committed to fiscal consolidation. This is likely to support the Kenyan Eurobond market in the near term.

Zambia

Zambia’s Eurobond market experienced mixed performance in Q3 2023. Yields were down in the early part of the quarter, but rose in mid-July. Yields remained elevated for the rest of the quarter, as investors weighed global economic risks and Zambia’s ongoing debt restructuring process.

Zambia is currently negotiating with its creditors to restructure its debt. This process is complex and challenging, but it is essential for Zambia to achieve long-term debt sustainability. The outcome of the debt restructuring process will have a significant impact on Zambia’s Eurobond market in the near term.

Global Fixed Income Outlook for Q4 2023

Bond Market

The outlook for the Nigerian local bond market in Q4 2023 remains uncertain. The new CBN administration is expected to clear the fog in the eyes of investors and provide monetary policy guidance.

Eurobond market

The outlook for the SSA Eurobond market in Q4 2023 is uncertain. Global economic risks, domestic economic developments, and central bank decisions will all play a role in determining market performance.

On the global front, the US Federal Reserve is expected to continue raising interest rates in Q4 2023. This could lead to capital outflows from SSA markets and put upward pressure on Eurobond yields. Additionally, a slowdown in the global economy could reduce demand for SSA exports and weigh on economic growth.

On the domestic front, SSA governments will need to carefully manage their economies to mitigate the impact of global economic risks and domestic economic challenges. This includes addressing issues such as inflation, high debt levels, and foreign currency shortages. SSA governments that are successful in managing their economies will be better positioned to attract investment and support their Eurobond markets.